Bond Rate Impact Calculator

How Interest Rates Affect Bond Prices

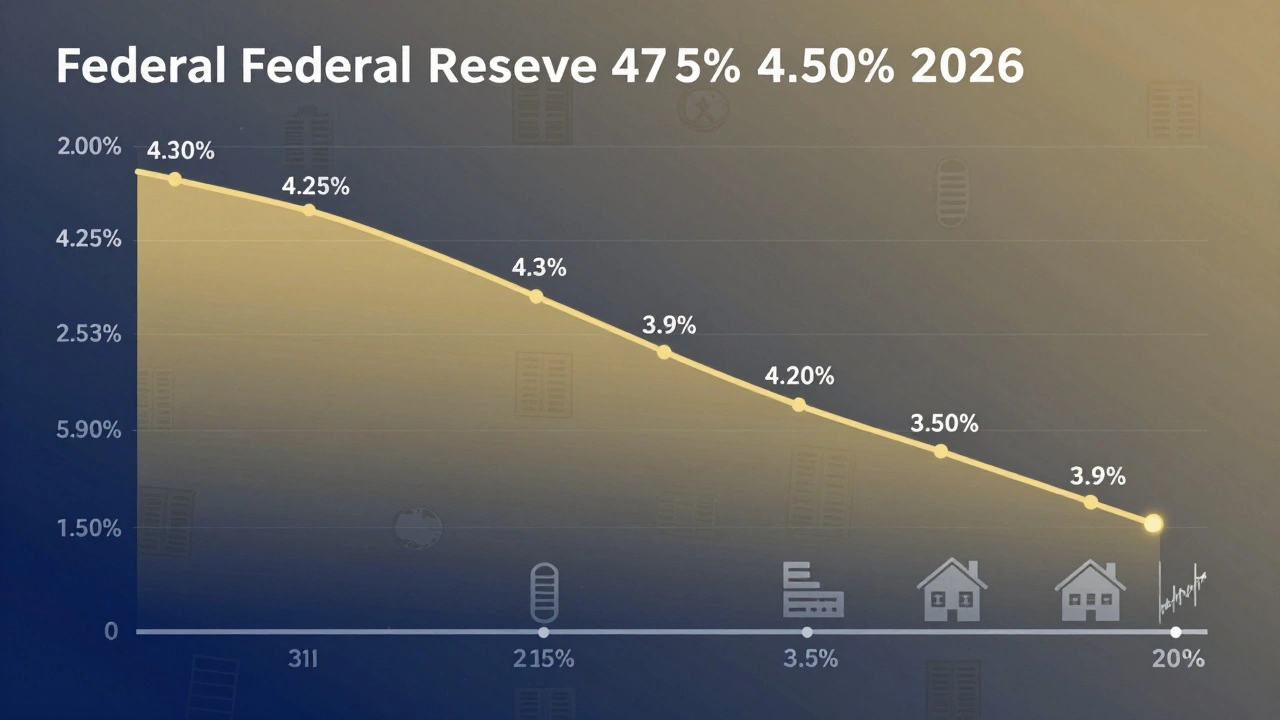

Based on the article's analysis of 2026 rate scenarios, this calculator shows how bond prices change when interest rates shift. The Fed projects the federal funds rate to settle between 3.25%-3.50% by 2026 (down from current 4.00%-4.25%).

Note: According to the article, intermediate-term bonds (5-10 years) offer the best balance. Long-term bonds (20+ years) are riskier if inflation rises, while short-term bonds (1-3 years) have minimal price movement.

What the Fed’s 2026 Rate Path Really Means for Your Portfolio

The Federal Reserve isn’t just tweaking interest rates anymore-it’s rewriting the rules for how money moves through the economy. By the end of 2026, the federal funds rate is expected to settle between 3.25% and 3.50%, down from the current 4.00%-4.25%. That might sound like a small shift, but it’s a seismic change for bonds, stocks, and your investments. This isn’t a panic-driven cut. It’s a deliberate, data-driven pivot. And if you’re still holding cash or long-term bonds the way you did in 2023, you’re already behind.

The Fed’s September 2025 projections show inflation still hovering around 2.6% by year-end 2026-higher than the 2% target, but clearly cooling. That’s the sweet spot they’re aiming for: enough slowdown to tame prices without triggering a recession. The labor market is the real tiebreaker here. If job losses start piling up, the Fed will cut faster. If wages keep rising and services inflation sticks, they’ll pause. That uncertainty is what’s driving market volatility right now.

Bond Markets: The 10-Year Treasury Is the New Benchmark

When the Fed cuts rates, long-term bonds usually rally. But this time, it’s not a simple story. The 10-year Treasury yield is projected to fall from 4.3% in late 2025 to around 3.9% by the end of 2026. That’s a 40-basis-point drop. For a bond with a duration of 9 years, that translates to roughly a 3.5% to 4% price gain. Not bad. But here’s the catch: not all bonds benefit equally.

Intermediate-term bonds-those with 5 to 10 years to maturity-are the sweet spot. They offer enough yield to be attractive now, but enough duration to capture most of the price appreciation as rates fall. Long-term bonds like 20+ year Treasuries (TLT) are riskier. If inflation surprises to the upside, their prices can drop hard. Short-term bonds (like 1-3 year notes) won’t move much. Their yields are already close to the Fed’s target.

Here’s what’s happening behind the scenes: mortgage rates are expected to widen against 10-year yields by 1.3 percentage points in mid-2026 before tightening again. That means mortgage-backed securities (MBS) could face short-term pressure. Banks and institutional investors holding large MBS portfolios are bracing for volatility. If you’re investing in bond funds, check the duration and exposure to housing-related debt. Not all bond ETFs are created equal.

Equities: Who Wins, Who Loses When Rates Fall

Stocks have been riding high since 2023, fueled by AI hype and strong earnings. But the next leg up won’t be led by just Big Tech. When the Fed starts cutting, the market rotates. Historically, sectors that are sensitive to interest rates outperform.

Real estate investment trusts (REITs) and utilities are classic beneficiaries. They pay steady dividends and act like bonds with growth. As yields fall, their relative value goes up. The same goes for consumer staples and healthcare-defensive names with pricing power. These aren’t flashy, but they’re reliable.

Financials? That’s the wildcard. Banks make money on the spread between what they lend and what they pay. If short-term rates fall faster than long-term rates, the yield curve flattens. That squeezes net interest margins. J.P. Morgan’s analysts say this won’t be catastrophic-just a headwind. But it’s enough to make bank stocks lag behind the broader market.

And don’t forget growth stocks. They’ve been the darlings of the past two years. But if inflation stays sticky and the Fed cuts slower than expected, their high valuations could come under pressure. Quality matters more than ever. Look for companies with low debt, strong cash flow, and real pricing power-not just hype.

The Two Scenarios: Soft Landing vs. Sharp Downturn

The Fed’s official projections assume a soft landing. But they also run stress tests. And those tell a different story.

In the baseline scenario, the Fed cuts 25-50 basis points in 2026, bringing the funds rate to 3.25%-3.50%. Markets price that in. But in the severely adverse scenario, the U.S. economy slows sharply. Unemployment jumps. Inflation doesn’t budge. And the Fed responds with 200-300 basis points of cuts in 2026 alone. That’s a full percentage point drop in just one year.

That kind of move would send the 10-year Treasury yield tumbling below 3%, and stocks soaring-especially in sectors like tech and industrials that benefit from cheap capital. But it would also mean a recession. And no one wants that.

The real question isn’t whether the Fed will cut. It’s whether they’ll have to cut hard. The difference between a 25-basis-point cut and a 200-basis-point cut isn’t just a number. It’s the difference between a healthy adjustment and a financial crisis.

What Investors Are Doing Right Now

Professional investors aren’t waiting for the Fed to make the next move. They’re positioning now.

S&P Global found that 68% of institutional portfolio managers have increased their exposure to longer-duration bonds. That’s a clear bet that rates will keep falling. Meanwhile, 52% are overweight in growth stocks over value. They’re betting the economy stays strong enough to support earnings, but weak enough to justify rate cuts.

On the retail side, Reddit threads are buzzing about laddering Treasury bonds. Instead of buying one long bond, investors buy a series of bonds maturing in 1, 2, 3, 5, and 7 years. As each bond matures, they reinvest in a new 7-year note. That way, they lock in higher yields now but still benefit as rates fall over time. It’s simple, it’s effective, and it’s how smart money plays the game.

Others are avoiding cash. BlackRock says cash yields will fall to 3.4% by the end of 2026. That’s still better than savings accounts, but it’s not a return-it’s just a holding cost. If you’re sitting in money market funds, you’re missing the rally. Move some into short-term Treasuries or a diversified bond fund.

How to Prepare for 2026

Here’s what you need to do right now:

- Check your bond portfolio’s duration. If it’s under 3 years, you’re missing out. If it’s over 15 years, you’re taking too much risk.

- Shift toward intermediate-term Treasuries (5-10 years). Use ETFs like IEF or Vanguard’s intermediate-term bond fund.

- Overweight sectors that benefit from lower rates: real estate, utilities, healthcare.

- Avoid overpaying for growth stocks with no earnings. Look for companies with real cash flow and low debt.

- Don’t chase yield. If a bond fund is offering 6%+ returns, ask why. It’s probably loaded with risky corporate debt.

- Keep 6-12 months of expenses in cash or short-term Treasuries. You’ll need liquidity if the market turns.

The Fed’s job isn’t to make you rich. It’s to keep the economy from crashing. Your job is to adapt. The rate path for 2026 isn’t a crystal ball-it’s a map. And if you follow it carefully, you won’t just survive the transition. You’ll thrive through it.

Frequently Asked Questions

Will the Fed cut rates in December 2025?

There’s a 60% chance based on futures markets. The Fed signaled it’s ready to cut if inflation continues cooling and labor data doesn’t spike. A December cut is likely, but it won’t be a signal of panic-it’s more like an insurance move to prevent job losses.

How will 2026 rate cuts affect mortgage rates?

Mortgage rates won’t fall as fast as the Fed funds rate. They’re tied to 10-year Treasury yields, which are falling more slowly. Plus, mortgage spreads are expected to widen temporarily in mid-2026 due to stress in the housing market. So while rates will drop, they’ll stay higher than you might expect. Don’t wait for a big plunge-lock in if you’re ready to buy.

Are bonds still a good investment if inflation is still above 2%?

Yes-if you pick the right ones. Bonds with yields above inflation still deliver real returns. A 3.8% 10-year Treasury with 2.6% inflation gives you a 1.2% real yield. That’s better than cash. And if inflation falls further, bond prices rise. The key is avoiding long-duration bonds if inflation stays sticky.

Should I sell my stocks before the Fed cuts?

No. Historically, stocks rise in the first 6-12 months after the first Fed cut. The biggest gains often come from sectors that were overlooked in the boom years-like utilities and real estate. Selling now means you’ll miss the rotation. Instead, rebalance: trim tech, add defensive stocks.

What’s the biggest risk to the Fed’s 2026 plan?

Wage growth. If service-sector wages keep rising faster than productivity, inflation won’t fall to 2%. That could force the Fed to pause cuts or even hike again. The labor market is the wildcard. Watch the unemployment rate and average hourly earnings every month.

Is now a good time to buy Treasury bonds?

Yes, if you’re buying with a 5-7 year horizon. Current yields on 5-10 year Treasuries are near 4%. That’s attractive compared to the 3.4%-3.6% yields you’ll likely see by late 2026. Buy in stages-don’t put all your money in at once. Ladder your purchases to avoid timing risk.