2026 Inflation Expectations: What’s Driving Prices and How It Will Affect Your Wallet

When people talk about 2026 inflation expectations, the collective forecast of how much prices will rise by 2026, shaped by consumer behavior, policy signals, and market data. Also known as inflation forecasts, it’s not just guesswork—it’s a mix of what households believe, what businesses plan for, and what central banks are trying to control. This isn’t about yesterday’s grocery bill. It’s about whether your paycheck will stretch further in two years—or if you’ll need to cut back just to keep up.

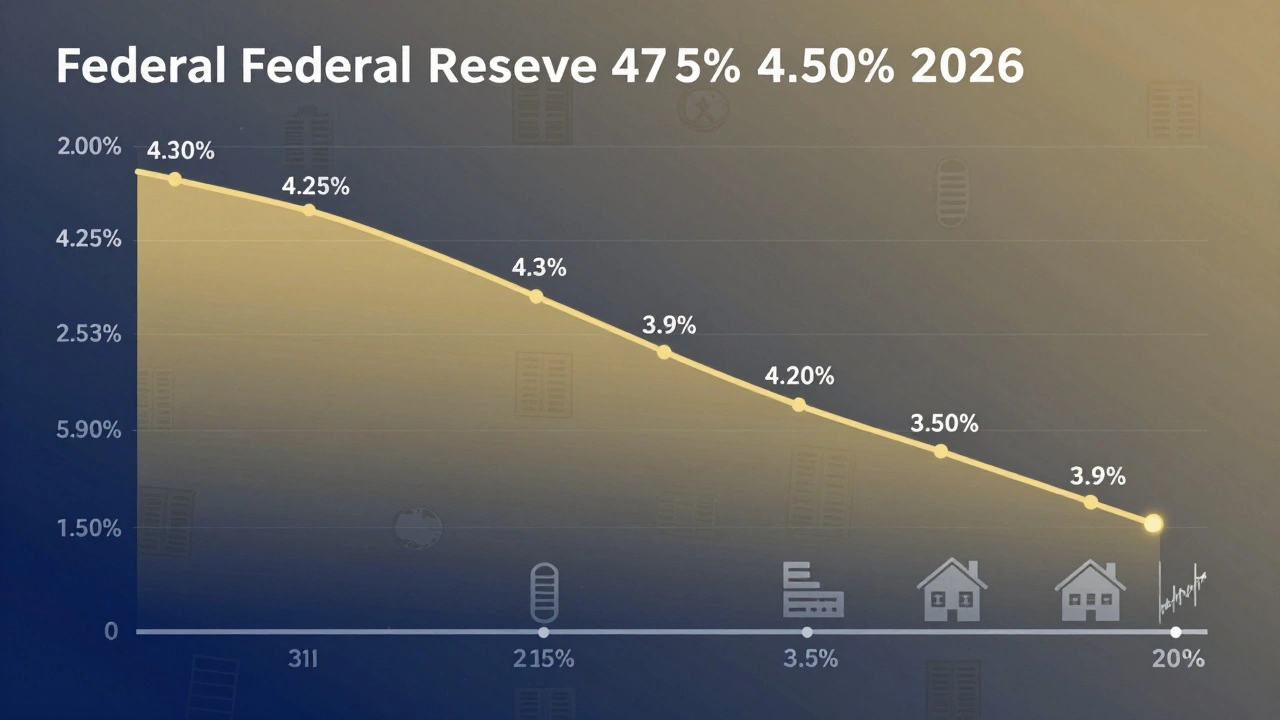

Behind every inflation number is a story. Central bank policy, the actions taken by institutions like the Federal Reserve or ECB to manage money supply and interest rates is the biggest lever. If they keep rates high too long, growth slows. If they drop them too soon, prices surge again. Then there’s wage growth, how much workers are earning more year over year, which directly feeds into business costs and pricing decisions. When employees demand raises to match rising rent and food bills, companies often pass those costs on. That’s not greed—it’s survival. And it’s happening in sectors from healthcare to trucking, where labor shortages are real and non-negotiable.

Don’t forget supply chain costs, the hidden price tags from shipping delays, tariffs, and reshoring efforts that make everything from electronics to furniture more expensive. The pandemic didn’t just disrupt logistics—it rewrote the rules. Now, companies are paying more to move goods through friendlier but pricier countries, not just because of politics, but because they can’t risk another shutdown. That cost doesn’t vanish. It shows up on your receipt.

These aren’t isolated forces. They feed each other. Higher wages push up prices. Higher prices make workers demand more pay. Supply chain bottlenecks make goods scarcer and costlier. And when all this happens at once, inflation expectations become self-fulfilling. People start buying now because they think things will cost more later. Businesses raise prices because they expect costs to keep climbing. It’s a cycle—and breaking it isn’t about one policy move. It’s about balancing five moving parts at once.

Look at what’s already happening. Countries with strong childcare support and paid leave are seeing higher female workforce participation, which boosts productivity and helps keep wage pressures in check. Meanwhile, places relying on fossil fuel imports are getting hit harder by energy shocks. AI-driven logistics are cutting some costs, but also making pricing more opaque. Climate finance is shifting capital away from carbon-heavy industries, raising transition costs. And geopolitical fragmentation—like trade blocs and export bans—is turning global supply chains into regional patchworks, each with its own inflation rhythm.

What you’ll find in the posts below isn’t just data points. It’s the real-world machinery behind inflation: how companies are adjusting pricing, how governments are trying to stabilize costs, and where the next pressure points are forming. You’ll see how pension funds are reacting, how tech firms are building inflation buffers into budgets, and why even the smallest businesses are changing how they order inventory. This isn’t theory. It’s what’s happening right now—and what’s coming next.