Bond Market Outlook: What’s Driving Yields, Inflation, and Global Capital Flows

When you hear bond market outlook, the collective forecast of how government and corporate debt will perform based on interest rates, inflation, and economic growth. Also known as fixed income outlook, it’s not just about numbers on a screen—it’s about where trillions in global savings are going, who’s winning, and who’s getting left behind. Right now, the bond market is doing something unusual: it’s leading the economy instead of following it. Investors aren’t waiting for central banks to act—they’re pricing in rate cuts, recessions, and even inflation surprises before the data even comes out.

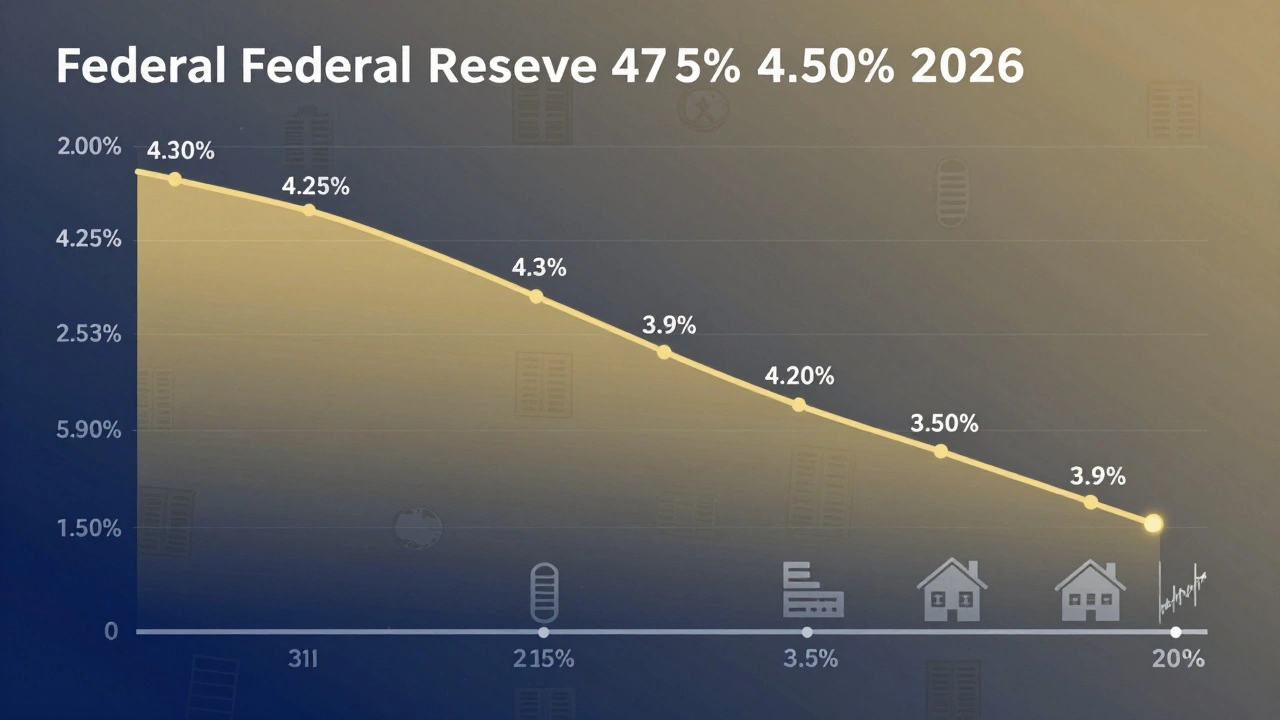

That’s because government bonds, debt issued by national governments used to fund spending and manage monetary policy are the world’s safest asset—and when safety gets expensive, everything else shakes. The U.S. Treasury market alone holds over $26 trillion in outstanding debt. When foreign buyers like Japan and Saudi Arabia slow their purchases, or when the Fed stops reinvesting maturing bonds, yields rise. And when yields rise, mortgages, car loans, and business loans all get pricier. It’s a chain reaction. Meanwhile, interest rates, the cost of borrowing money, set by central banks and reflected in bond yields are still higher than they’ve been in 20 years, but markets are betting they’ll drop soon. Why? Because inflation is cooling, but growth is slowing. That’s the tightrope central banks are walking.

The yield curve, a graph showing bond yields across different maturities, often used as a recession predictor is another key signal. When short-term rates are higher than long-term rates (an inverted curve), it usually means investors expect trouble ahead. That’s happened before every recession since 1955. Right now, it’s flattening again. Not inverted yet—but close enough to make investors nervous. And with inflation, the rate at which prices rise, eroding purchasing power and forcing central banks to adjust policy still above target in places like the U.S. and the U.K., central banks can’t afford to cut too fast. But if they wait too long, they risk triggering a slump. That’s why bond traders are so focused on every jobs report, CPI number, and Fed speech.

What’s clear from the posts below is that this isn’t just about bonds. It’s about how bond market outlook connects to everything else: AI’s impact on financial stability, the rise of private credit, the push for green bonds, and even how countries like China are using digital currencies to reshape global finance. The bond market doesn’t operate in a vacuum. It reacts to energy security in Europe, to union contracts that affect corporate debt, to climate policy that shifts investor flows, and to whether young workers can afford to buy homes in a high-rate world. You can’t understand the future of money without understanding where bonds are headed.

Below, you’ll find real analysis from across the globe—how AI is making trading riskier, why green finance is now tied to national security, how private credit is replacing banks, and what’s really happening with central bank digital currencies. These aren’t isolated stories. They’re all threads in the same fabric. And the bond market is the loom holding it all together.