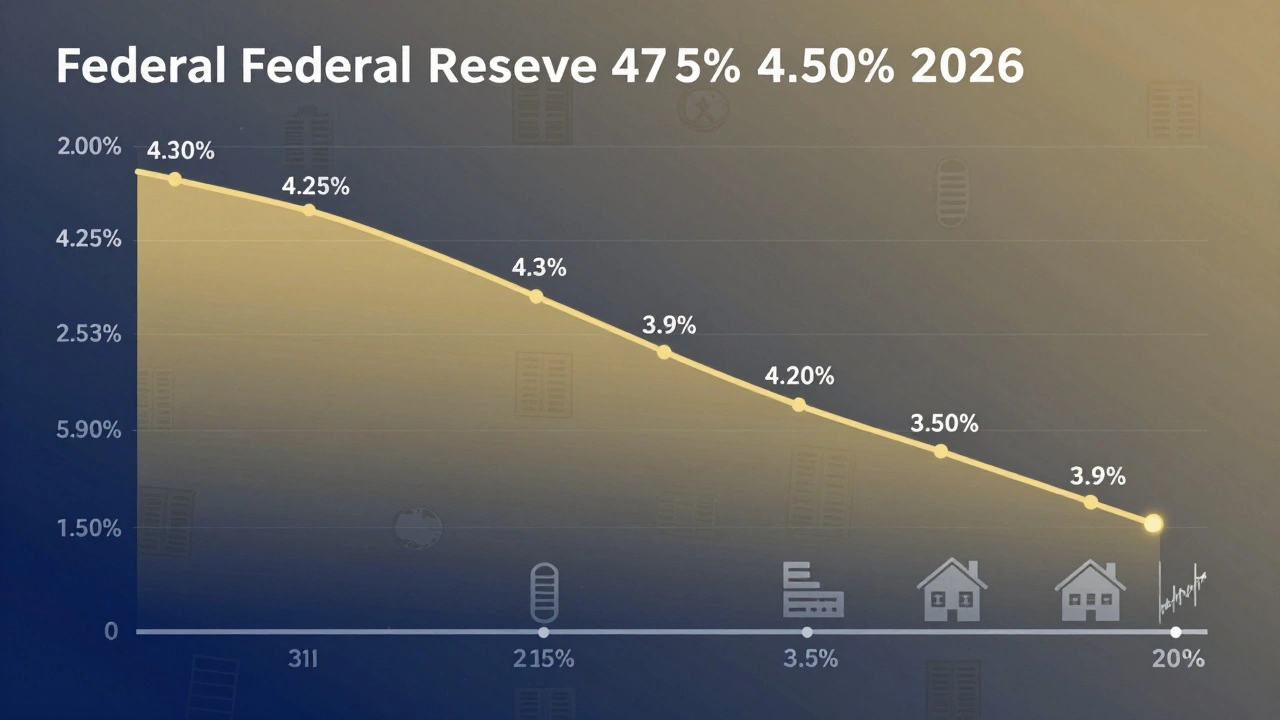

Federal Reserve rate path

When you hear about the Federal Reserve rate path, the planned direction of interest rates set by the U.S. central bank to control inflation and support employment. Also known as the policy rate trajectory, it’s not just a chart on a Bloomberg terminal—it’s the hidden force behind your mortgage payments, credit card interest, and even whether your local business can hire more staff.

The interest rates, the cost of borrowing money set by the Fed through its federal funds target don’t move in a vacuum. They’re tied directly to inflation, the rate at which prices for goods and services rise, eroding purchasing power. When inflation spikes, the Fed raises rates to cool spending. When the economy slows, it cuts them to encourage borrowing and hiring. This back-and-forth is the core of monetary policy, the tools the Federal Reserve uses to manage the nation’s money supply and economic health. And it’s not just about the U.S. anymore—global markets react in seconds. A rate hike in Washington ripples through Europe’s bond markets, shifts capital flows in Asia, and changes how companies abroad borrow or invest.

Look at the posts below. You’ll see how the Fed’s decisions connect to private credit growth as banks pull back and lenders step in. You’ll find how central bank digital currencies like the digital dollar could one day change how rate policy is delivered. You’ll see how financial stability is at risk when AI-driven trading amplifies rate-driven market swings. And you’ll learn how sustainable investing is being reshaped as investors weigh climate risks against rising borrowing costs. This isn’t abstract economics—it’s about your job, your savings, your home, and your future.

The Fed doesn’t announce rate changes like a weather forecast. It gives hints, publishes projections, and lets markets guess. That uncertainty is what makes the rate path so powerful—and so disruptive. The posts here cut through the noise. They show you how real people, businesses, and governments are adapting when the Fed shifts gears. Whether you’re watching housing costs, planning a business loan, or just trying to understand why your paycheck doesn’t stretch like it used to, what happens next with the Fed’s rate path matters more than you think. Below, you’ll find the clear, grounded analysis you won’t get from headlines.