Global Power Balance Calculator

Calculate Economic Influence Shifts

Compare the economic power of traditional vs emerging economies using real-world data from the article.

Power Distribution Analysis

G7 Share:

BRICS Share:

Global South Share:

Article Context: In 2025, the G7's share of global GDP dropped below 30%. BRICS now represents 40% of global GDP, with the Global South comprising over 60% of world population.

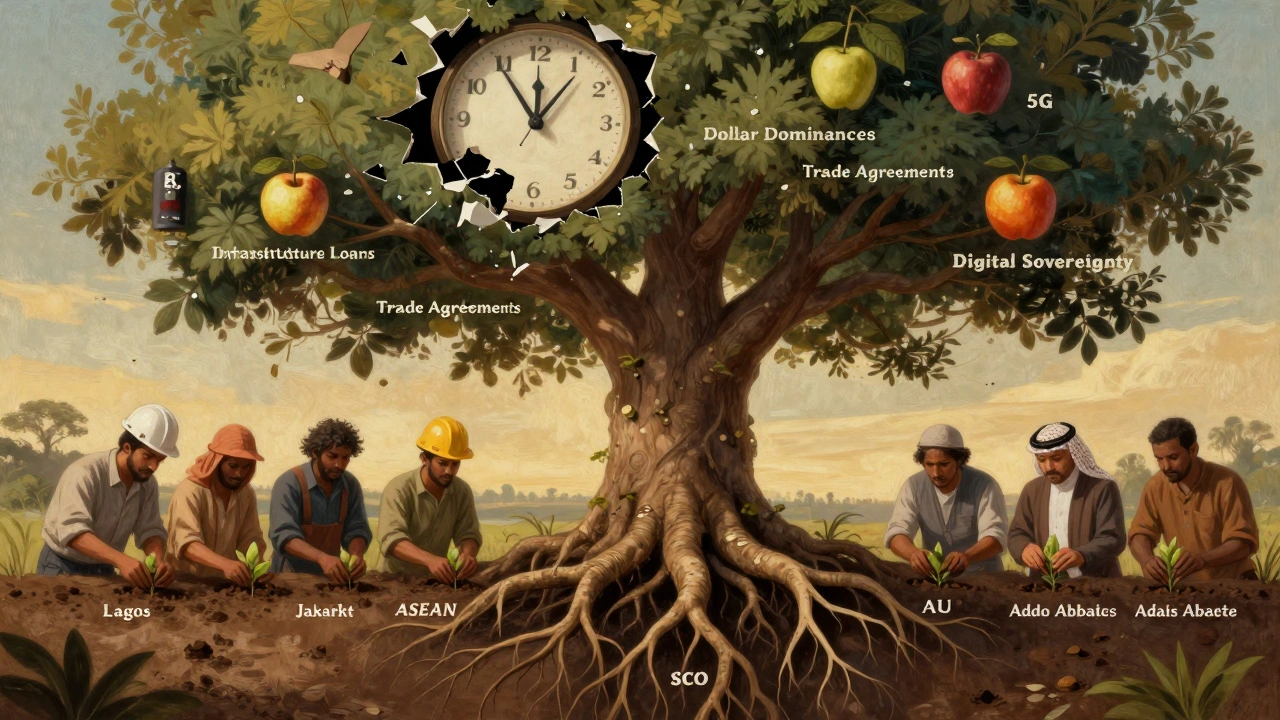

The world isn’t governed by Washington or Beijing alone anymore. It hasn’t been for years. What we’re seeing now isn’t just a shift in power-it’s a full rewrite of the rules. Countries from Africa to Latin America to Southeast Asia are no longer waiting for permission to shape global outcomes. They’re building their own systems, their own networks, their own rules. And the old order? It’s scrambling to keep up.

The End of the Western Monopoly

For decades, the G7 acted like the world’s boardroom. They set the rules on trade, finance, and security. But by 2025, their share of global GDP had dropped below 30%. That’s not a slow decline-it’s a collapse of influence. Meanwhile, emerging economies have been quietly stacking up power. China’s manufacturing output alone now outpaces the U.S., Japan, and Germany combined. Brazil’s trade with China hit $154 billion in 2024-more than its trade with the U.S. India’s economy is growing faster than any G7 nation. And it’s not just about size. It’s about choice.The Global South-over 130 countries that make up more than 60% of the world’s population-is no longer a passive audience. They’re the new players. And they’re not asking for a seat at the table. They’re building their own table.

BRICS and the New Financial Architecture

In January 2024, BRICS launched the BRICS Bridge payment system. By mid-2025, it had processed $4.7 trillion in transactions among member states. That’s not a side project. It’s a direct challenge to SWIFT, the U.S.-dominated global banking network that once controlled 95% of cross-border payments.When BRICS expanded in July 2025 to include Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE, it didn’t just add members-it added weight. Suddenly, the bloc represented 45% of the world’s population and 40% of global GDP. That’s more than the G7. And it’s not just about money. It’s about control. Countries now have an alternative to dollar-based loans, sanctions, and financial pressure.

The New Development Bank, founded by BRICS in 2015, has already funded over $30 billion in infrastructure projects across Africa, Asia, and Latin America. No IMF conditions. No austerity demands. Just partnerships based on mutual need.

Multi-Alignment: The Art of Playing Both Sides

Forget choosing between the U.S. and China. That’s not how it works anymore. The smartest players are doing both.India is in QUAD with the U.S., Japan, and Australia-yet it’s also a core member of BRICS and the SCO. Nigeria secured a $5.2 billion Chinese loan for a highway project while also getting a $3.8 billion U.S. development package for the same project. Egypt is talking to Saudi Arabia and Russia about energy deals while still receiving U.S. military aid.

This isn’t hypocrisy. It’s survival. It’s called multi-alignment. And it’s the defining strategy of the new era. Countries aren’t picking sides-they’re picking tools. They want U.S. tech, Chinese infrastructure, Russian arms, and EU climate funding. All at once.

The problem? It’s exhausting. A Brazilian diplomat told researchers that the constant balancing act creates pressure to choose sides, especially when it comes to tech standards or security pacts. One day you’re adopting Chinese 5G. The next, you’re signing a U.S. data privacy deal. You need lawyers, diplomats, and engineers who speak English, Mandarin, and Arabic. And you need to understand three different legal systems.

The Rise of Regional Blocs

Multipolarity isn’t just about big countries. It’s about regional networks.In Southeast Asia, ASEAN has become the quiet architect of stability. It doesn’t take sides in U.S.-China tensions. It just keeps trade flowing. In Africa, the African Union’s Agenda 2063 is building a continental free trade zone that’s already reducing reliance on European imports. In Latin America, CELAC is coordinating energy and food security policies without U.S. involvement.

Even the SCO-once seen as just a China-Russia security club-has grown into a major economic force. After adding Belarus and Mongolia in June 2025, it now covers 33.8% of global GDP. Its members aren’t just talking about security. They’re building rail links, energy grids, and digital payment bridges.

These aren’t alliances against the West. They’re alliances for autonomy. And they’re working.

The Cost of Fragmentation

This new system isn’t perfect. It’s messy. And it’s expensive.When every country uses different digital standards, it creates friction. China’s CIPS payment system processed $12.8 trillion in 2024. The EU has GDPR. Brazil has LGPD. The U.S. has no federal privacy law. Companies trying to operate across borders now face compliance costs estimated at $1.2 trillion a year.

Supply chains are broken. After the 2023 semiconductor shortage, 78% of major economies started reshoring or diversifying suppliers. That’s good for resilience. But it’s bad for efficiency. The World Bank says global trade is now 18% slower than it was in 2019.

And when crises hit-like the 2023-2024 viral outbreaks-there’s no unified response. No global coordination. Just a patchwork of national policies, conflicting travel rules, and vaccine nationalism.

Experts like John Mearsheimer warn this is how great power wars start. History shows multipolar systems are unstable. The pre-WWI era had multiple powers, overlapping alliances, and miscalculations that led to catastrophe.

But here’s the difference: today’s powers aren’t trying to conquer each other. They’re trying to coexist. And they’re doing it through trade, not tanks.

Who’s Winning? The Global South

The real winners aren’t the giants. They’re the middleweights. The countries that used to be ignored.Indonesia expanded its foreign service by 42% since 2020. Brazil opened 18 new embassies in Africa between 2022 and 2025. The UAE turned non-oil sectors into 72.3% of its GDP. These aren’t lucky breaks. They’re strategic bets.

And the people? Social media analysis from the 2025 SCO summit showed 68% positive sentiment among Global South citizens. Comments like “finally having a voice” and “reduced dependency on Western financial systems” dominated. People are tired of being told what to do.

They’re not rejecting the West. They’re rejecting subordination.

The New Rules of Power

Power today isn’t just about military bases or nuclear weapons. It’s about payment systems. It’s about who controls the data. It’s about who builds the roads, trains the engineers, and funds the universities.The U.S. still has the most powerful military. China has the most factories. But the real power now lies in who gets to set the standards. Who gets to name the currency. Who gets to decide what’s fair.

And for the first time in modern history, that power is being shared-not handed down.

The old map is fading. The new one is being drawn by engineers in Lagos, diplomats in Jakarta, bankers in Riyadh, and farmers in Addis Ababa. They’re not waiting for permission. They’re building the future-brick by brick, transaction by transaction, alliance by alliance.