Innovation Cluster Readiness Assessment

Evaluate your region's potential to build a successful innovation cluster using the framework from the article "National Innovation Clusters: How Governments Build Tech Hubs That Win Global Competition".

Step 1 of 5

Cluster Readiness Score

0/100

Key Recommendations:

Think about why Silicon Valley still dominates global tech. It’s not just because of Stanford or venture capital. It’s because decades of deliberate policy, collaboration, and investment turned a patchwork of labs and startups into something bigger - a self-reinforcing ecosystem where talent, ideas, and money flow in one direction: forward. That’s what innovation clusters are. And countries that get them right don’t just grow their economies - they lead the next wave of technology.

What Exactly Is an Innovation Cluster?

An innovation cluster isn’t just a bunch of tech companies in one city. It’s a living network: universities pumping out research, startups testing new products, suppliers making specialized parts, investors betting on the next big thing, and government agencies removing roadblocks. These pieces don’t just coexist - they interact constantly. A researcher at MIT talks to a founder in Cambridge. A manufacturer in Raleigh partners with a university lab. A venture firm in Boston funds a spinout from Harvard. That’s the magic. The difference between a cluster and a regular business district? Interaction. Density. Trust. In Silicon Valley, engineers swap ideas over coffee. In Boston’s Route 128, labs share equipment. In Norway’s Ocean Technology cluster, shipbuilders and AI developers sit in the same meeting rooms. These aren’t accidents. They’re designed.Why Do Governments Care So Much?

Because clusters don’t just create jobs - they create good jobs. They boost productivity. They attract global investment. And they make regions resilient. Studies show that areas with strong clusters see 3-8% higher regional productivity. Patent activity jumps 12-18%. Productivity grows 8-12% faster than in non-cluster regions. Countries that ignore this are falling behind. The U.S., Canada, Denmark, Norway, Scotland, and the UK all have national cluster strategies. Ireland and Finland, by contrast, struggled for years because they didn’t have a coordinated system - their clusters were left to chance. That’s like hoping your startup succeeds without a business plan. The goal? Win in the next tech frontier: AI, clean energy, biotech, advanced manufacturing. China is pouring billions into AI clusters. The EU is linking clusters across borders. The U.S. is trying to catch up with programs like the Small Business Administration’s Regional Innovation Clusters (RIC), which gives up to $600,000 per year to support local tech ecosystems.The Three Ways Clusters Are Built

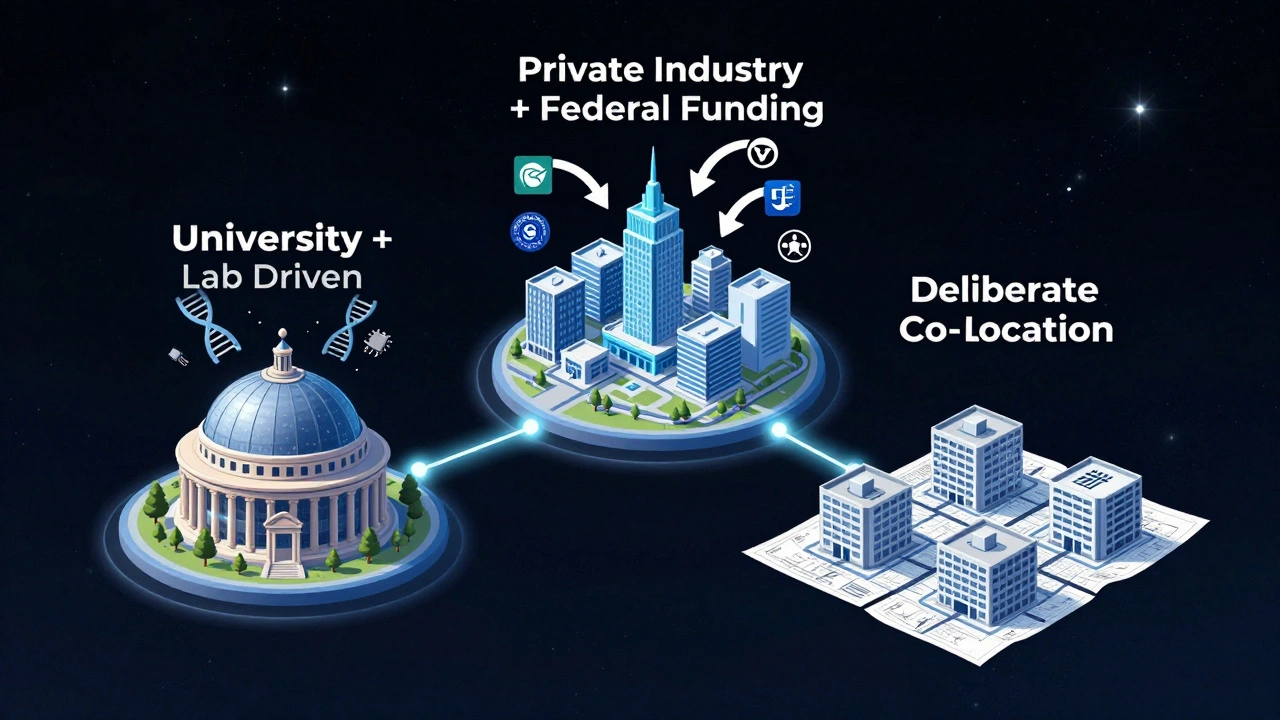

There are three real paths to building a cluster - and governments need to know which one fits their region.- University + Lab Driven: Think Boston. Research labs at MIT and Harvard spin out companies. The government funds basic science. Private firms follow. This works when you have world-class universities and a culture of academic entrepreneurship.

- Private Industry + Federal Funding: Silicon Valley is the classic example. Private companies drove the early growth, but federal defense and research funding (like DARPA) gave them the tools to scale. This model needs strong private-sector leadership and long-term public investment.

- Deliberate Co-Location: Research Triangle Park in North Carolina. The government bought land, built infrastructure, and convinced IBM, Duke, and UNC to move in. This works when you don’t have an organic hub - but you have a plan.

How Countries Are Doing It Differently

Not every country builds clusters the same way. Here’s what works - and what doesn’t.Norway: Tiered Support Based on Maturity

Norway doesn’t throw money at everything. It classifies clusters into three levels:- Arena Clusters: Early-stage, small, regional. Think five local companies teaming up.

- Norwegian Centres of Expertise (NCE): Proven, growing, nationally important. Receives multi-year funding.

- Global Centres of Expertise (GCE): World leaders. These clusters bring in 30-50% of their funding from international sources and grow 15-20% annually.

Scotland: Building a System from Scratch

Scotland’s 2023 National Innovation Strategy admits: they didn’t have a clear system before. So they’re building one - the Scottish Cluster Scheme. It’s not about picking winners. It’s about analyzing clusters for size, maturity, and potential. Then matching support. That’s data-driven, not political.UK: Letting Data Decide

The UK’s Innovation Clusters Map uses a machine learning algorithm called HDBSCAN to find clusters based on actual business locations - not government guesses. They turned postcodes into latitude/longitude data, mapped every company, and let the algorithm find where innovation was already happening. That’s how you avoid bias. That’s how you find hidden gems.Denmark: The Hub-and-Spoke Model

Denmark has 14 “superclusters” - but they’re not isolated. They’re connected. The environment cluster in Aarhus talks to the energy cluster in Copenhagen. The maritime cluster in Odense shares talent with the life sciences cluster in Aalborg. This hub-and-spoke design prevents silos. It creates national strength through regional diversity.The Secret Sauce: Trust, Not Just Money

Money matters. But it’s not the biggest factor. The real engine? Trust. In successful clusters, companies compete fiercely - but also collaborate openly. They share talent. They co-develop standards. They solve industry-wide problems together. That doesn’t happen by accident. It’s built through:- Regular cross-sector meetings

- Joint R&D projects funded by public-private partnerships

- Leadership from industry - not just government

- Clear governance that balances power between universities, startups, and big firms

What Happens When It Goes Wrong?

Too many governments make the same mistakes:- Picking winners too early: Choosing a sector based on politics, not market potential. Result? Empty incubators.

- Underfunding long-term: Giving $2 million for a launch, then walking away. Clusters take 5-7 years to mature.

- Ignoring private leadership: Letting bureaucrats run the show. Clusters die without industry buy-in.

- Building silos: Universities, startups, and government don’t talk. No collaboration. No innovation.

What’s Next for Innovation Clusters?

The next phase isn’t just about building more clusters. It’s about connecting them. The EU’s Smart Specialization Platform is already linking clusters across borders - German AI clusters partnering with French robotics hubs, Dutch clean tech teams working with Polish manufacturers. Global value chains are shifting. Clusters that only look inward will lose. Also, focus is tightening. Clusters now target specific tech frontiers: AI infrastructure, hydrogen energy, quantum computing, advanced materials. No more vague “tech” labels. Clusters must answer: What will we lead the world in? And data is becoming central. The UK’s HDBSCAN approach is the future. Governments will stop guessing where innovation is - and start measuring it. Real-time data on patents, job growth, startup funding, and collaboration networks will guide funding decisions.Can Any Region Build a Cluster?

Yes - but not everyone can build the same kind. A rural town won’t become Silicon Valley. But it can become the world’s leading hub for sustainable forestry tech. A mid-sized city with a strong university can become a center for medical device innovation. The key isn’t size. It’s focus. Start with this:- What are your region’s existing strengths? (Universities? Legacy industries? Skilled workforce?)

- What global tech trends align with those strengths?

- Who are the key players already working together?

- What’s the biggest bottleneck? (Funding? Talent? Regulation?)

- Can you build a 5-year plan with clear milestones - not just a press release?