Fed rate cuts 2026: What They Mean for Your Money, Markets, and Economy

When the Fed rate cuts 2026, reductions in the federal funds rate set by the U.S. Federal Reserve to stimulate economic activity. Also known as monetary easing, it’s not just a number on a chart—it’s the hidden lever that affects your mortgage, your savings, and whether your local business can hire more staff. The Fed doesn’t cut rates because it feels like it. It does it when inflation cools, growth slows, or job markets start to crack—and 2026 could be the year all those signals line up.

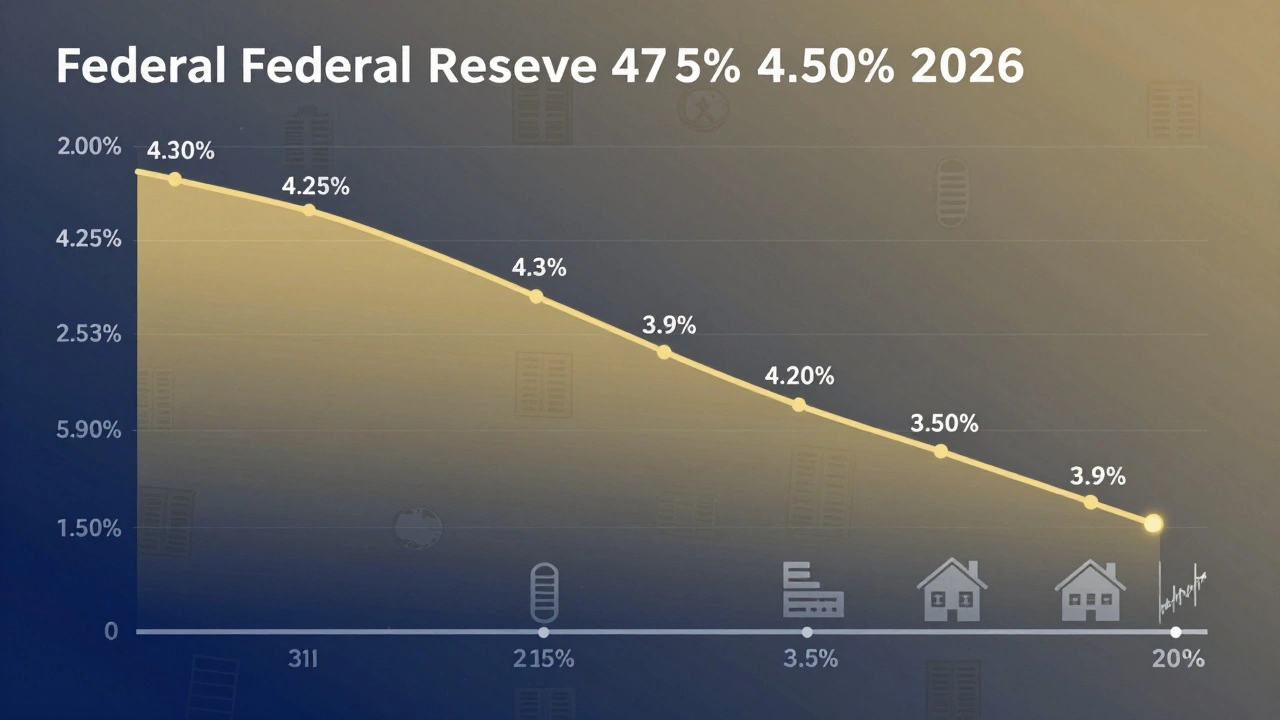

Rate cuts don’t happen in a vacuum. They’re tied to inflation, the rate at which prices for goods and services rise over time. If inflation stays below 2% for months, the Fed has room to lower rates to keep the economy from stalling. But if inflation flares back up, even a small cut could trigger market panic. That’s why traders watch consumer price data like hawk-eyed gamblers. And it’s why monetary policy, the tools central banks use to control money supply and interest rates has become more unpredictable than ever. With global supply chains still shaky, AI reshaping labor markets, and CBDCs quietly changing how money moves, the Fed isn’t just reacting to U.S. data anymore—it’s reacting to the whole world.

What happens when rates drop? Borrowing gets cheaper, so homebuyers might finally get back in the market. Small businesses could refinance debt and expand. But if you’re saving for retirement, your savings accounts and CDs will earn less. The stock market might jump on the news, but not always for the right reasons—sometimes it’s just speculation. And here’s the catch: rate cuts don’t fix broken systems. They can’t fix housing shortages, teacher shortages, or weak wage growth. They’re a bandage, not a cure. That’s why the posts below don’t just talk about interest rates—they show you how rate cuts connect to everything from private credit lending to energy security and AI-driven finance. You’ll see how a Fed decision in Washington ripples through Baltic population trends, European grid resilience, and vaccine manufacturing hubs halfway across the globe. This isn’t just about numbers on a screen. It’s about who wins, who loses, and how fast things change when the central bank shifts gears.