Geoeconomic Fragmentation Impact Calculator

Calculate Your Fragmentation Impact

Estimate how trade fragmentation affects your business costs, consumer prices, and economic growth based on key parameters from the article.

Estimated Impact

By 2025, the global trading system doesn’t look anything like it did in 2019. What used to be a single, interconnected web of supply chains, tariffs, and regulations has fractured into competing zones-each with its own rules, allies, and enemies. This isn’t just about higher prices at the store. It’s about how countries are choosing sides, building walls around their economies, and rewriting the very idea of what trade means.

What Geoeconomic Fragmentation Actually Looks Like Today

Geoeconomic fragmentation isn’t a buzzword. It’s a measurable shift. The International Monetary Fund calls it a policy-driven reversal of global integration, and by Q4 2024, its fragmentation index hit 0.78-up from 0.32 in 2019. That’s a 144% increase in economic division. Countries aren’t just trading less; they’re actively avoiding each other.

Take tariffs. Between 2022 and 2025, G7 nations raised average tariffs on strategic goods-semiconductors, rare earths, medical supplies-by 14.3%. But tariffs are just the tip. The real weight comes from non-tariff barriers: export controls, licensing rules, compliance checks, and technical standards that don’t match across borders. The European Central Bank found these non-tariff barriers now make up 67% of the total cost increase in trade between rival blocs.

It’s not just goods. Capital flows have dropped 22% since 2021. Foreign direct investment is now routed through politically safe channels. A company in Germany won’t invest in a factory in Vietnam if it risks being cut off from U.S. markets. That’s not market logic-it’s political insurance.

The Three Rules of the New Trade Game

There are now three dominant frameworks shaping global trade, and businesses have to pick one-or play both sides at great risk.

- US-led Economic Prosperity Network: 27 countries, 41% of global GDP. Focus: tech control, semiconductor bans, strict export licensing. China is explicitly excluded.

- China’s Global Development Initiative: 68 nations, 33% of global GDP. Focus: infrastructure financing, alternative payment systems, state-backed supply chains. Western tech is often blocked.

- EU’s Open Strategic Autonomy: 27 members plus 14 associates. Focus: reducing dependency on adversaries, but at a cost. The EU now requires 40% of critical raw materials to be processed within its borders by 2030. Consumer prices for batteries and solar panels have jumped 4.3% because of it.

These aren’t just alliances. They’re economic blocs with legal teeth. The EU’s Critical Raw Materials Act isn’t a suggestion-it’s law. The U.S. CHIPS Act doesn’t just subsidize domestic chipmaking-it bans exports of advanced chips to China. In Q1 2025, semiconductor exports to China dropped 92% year-over-year.

Friend-Shoring Is the New Outsourcing

Remember when companies outsourced to the cheapest place? That’s over. Now, they outsource to the safe place.

According to Rhodium Group, 63% of all new manufacturing investments in 2024 went to countries aligned with the investor’s political bloc. A U.S. company building a battery plant? It’s going to Mexico or Poland, not Indonesia. A Chinese firm expanding its solar panel capacity? It’s setting up in Vietnam or Saudi Arabia-places that won’t risk U.S. sanctions.

This is called friend-shoring. It sounds benign, but it’s reshaping global production. The World Bank found that intra-regional trade grew at 5.8% annually since 2022, while trade between blocs grew at just 1.2%. The RCEP bloc (Asia-Pacific) saw 8.4% intra-bloc trade growth. The EU’s internal trade grew at 5.7%. But trade between the EU and China? Just 1.3%.

Companies like Samsung now run completely separate supply chains-one for the U.S.-aligned market, another for China-aligned markets. It doubles their costs, but it keeps them out of regulatory crosshairs.

Who’s Getting Hurt the Most?

Not everyone can pick a side. Small, open economies are getting crushed.

The IMF found that under severe fragmentation, small economies lose 4.8% of GDP-nearly double the 2.3% loss for large advanced economies. Why? They rely on global trade for survival. A country like Bangladesh, which exports 18% of its GDP in textiles, can’t suddenly switch from selling to the U.S. to selling to China if its factories don’t meet Chinese quality standards. And if it tries to serve both, it risks U.S. sanctions.

Even the BRICS+ bloc-now with nine members including Egypt, Iran, and the UAE-isn’t a true alternative. Together, they control 36.4% of global GDP. But internal trade among them? Just 21%. Compare that to the EU, where 65% of trade happens within the bloc. BRICS is a political club, not an economic union.

Emerging economies are also caught in a compliance trap. The World Trade Organization found that 67% of small businesses stopped exporting to politically misaligned markets because compliance costs ate up more than 15% of their revenue. One Reddit user, a logistics manager, reported a 300% increase in customs paperwork for U.S.-China shipments. Each container now costs $18,500 more in administrative fees.

The Hidden Costs: Innovation, Prices, and Productivity

Fragmentation isn’t just about trade volumes-it’s about what trade does for growth.

When companies can’t share technology across borders, innovation slows. The European Central Bank estimates fragmentation will reduce global productivity growth by 0.4 percentage points annually. That’s not a small number. Over ten years, it’s the difference between 1.8% and 1.4% growth-a compound loss equal to the entire GDP of South Korea.

Prices are rising too. Solar panels in Europe are 28% more expensive because local manufacturing can’t yet match China’s scale. Pharmaceuticals are harder to source. Semiconductors are scarcer. The World Health Organization warned that health security fragmentation has set back pandemic coordination to 2005 levels. Johns Hopkins University estimates this could cost the world $375 billion annually in future pandemic responses.

Even financial markets are feeling it. The Deutsche Bundesbank found that emerging economies dependent on foreign investment now pay 150-200 basis points more to borrow money. That’s a 1.5%-2% interest rate hike just because investors fear political risk.

Who’s Winning? And How?

Some businesses aren’t just surviving-they’re thriving by exploiting the cracks.

VNSemi, a semiconductor manufacturer in Vietnam, grew revenue by 217% in 2024. How? They positioned themselves as a neutral supplier. They don’t sell to China or the U.S. directly. They sell to companies that do. They’re the middleman in a fractured system.

Other winners? Countries that can play both sides. Mexico, Turkey, and India are seeing a surge in investment because they’re not fully aligned with either bloc. They’re becoming the new hubs for re-routing production.

And then there’s the regulatory advantage. The EU’s rules are clear, consistent, and well-documented. The World Bank gave them an 8.7/10 for clarity. Meanwhile, many emerging economies score below 5.2/10. Companies know where they stand in Brussels. They don’t know what’s coming next in Jakarta or Lagos.

What Comes Next?

There are two paths ahead.

The first: deeper fragmentation. Goldman Sachs gives a 65% chance we’re locked into this system through 2040. Geopolitical rivalries aren’t cooling. The U.S. and China are still building parallel tech ecosystems. The EU is tightening its rules. The CHIPS Act is expanding. China’s New Silk Route Certification now requires 89 specific standards for partners.

The second: market-driven reintegration. The Peterson Institute argues that by 2035, economic pressures will force trade costs back down to 80% of today’s levels. Businesses will find loopholes. Consumers will demand cheaper goods. Innovation will find ways around barriers.

But right now, the first path is winning. The IMF projects that under current trends, global GDP will be 2.8% lower by 2030 than it would be in a fully integrated world. Inflation will stay 1.2 percentage points higher. And the cost of doing business? It’s not going down.

What Should Businesses Do Now?

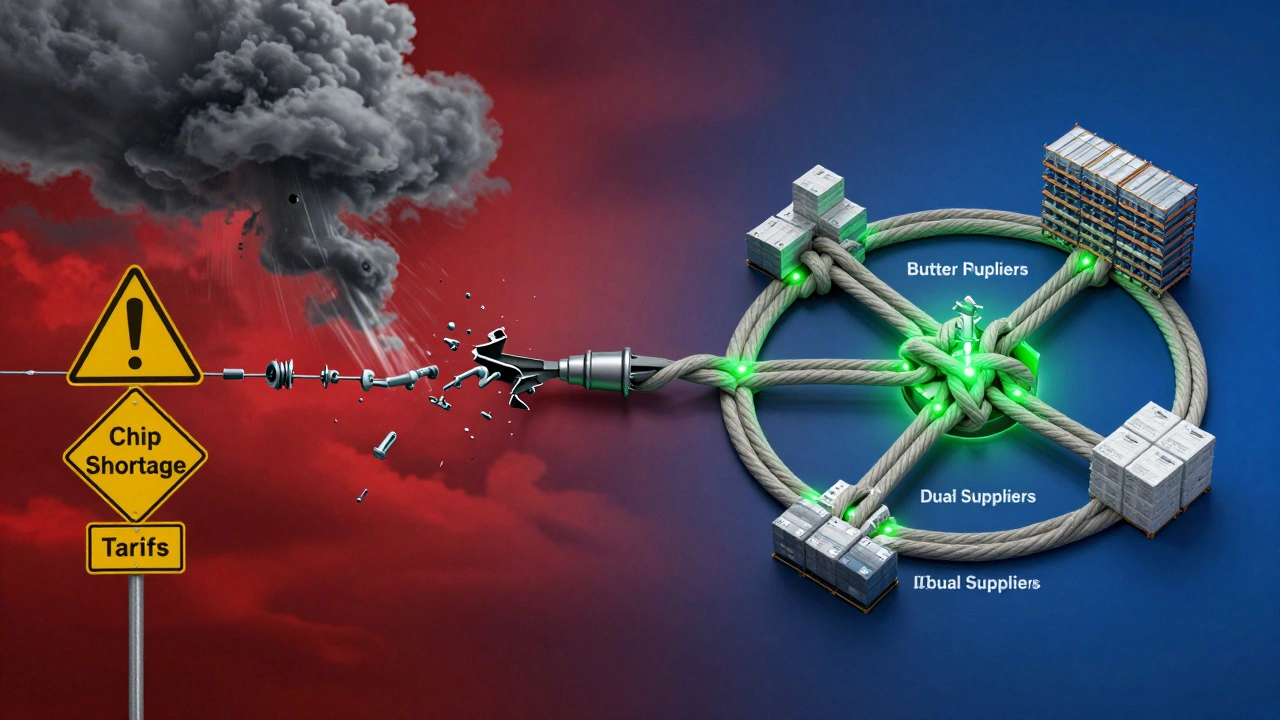

If you’re running a company in 2025, you can’t ignore this. Here’s what works:

- Map your supply chain by bloc. Know which suppliers, customers, and markets are in which alliance. Don’t assume alignment.

- Build dual-track operations. If you export to both the U.S. and China, you need separate inventory, compliance teams, and documentation systems.

- Factor in compliance costs. You’re now spending 18% of export revenue on regulatory compliance-up from 7% in 2020. Budget for it.

- Look for neutral zones. Vietnam, Mexico, Turkey, and Indonesia are becoming critical pivots. Consider them as buffer zones.

- Monitor regulatory changes weekly. New trade restrictions popped up 1,842 times between 2023 and 2025. You can’t rely on last year’s rules.

The WTO launched a Fragmentation Response Hub in November 2024. It’s already got 47,000 users. If you’re not using it, you’re flying blind.

Final Thought

This isn’t a temporary glitch. It’s a new operating system for global trade. The old rules-free flow, comparative advantage, efficiency above all-are gone. What’s left is security, sovereignty, and strategic control. The winners won’t be the cheapest. They’ll be the most adaptable.

What is geoeconomic fragmentation?

Geoeconomic fragmentation is the deliberate splitting of the global economy into competing regional blocs based on political alliances, not just market efficiency. It’s driven by policies like tariffs, export controls, and regulatory divergence to reduce dependence on rival nations-especially in critical sectors like semiconductors, energy, and rare earths.

How has trade changed since 2020?

Global trade growth slowed from an average of 4.7% annually (2010-2019) to just 1.8% in 2024. Intra-regional trade is growing 3.2 percentage points faster than trade between blocs. Tariffs on strategic goods rose 14.3% in G7 nations, and non-tariff barriers now account for 67% of increased trade costs.

What’s the difference between friend-shoring and outsourcing?

Outsourcing meant moving production to the lowest-cost location. Friend-shoring means moving it to politically aligned countries-even if it’s more expensive. In 2024, 63% of new manufacturing investments went to allies, not the cheapest option.

Are small businesses affected by trade fragmentation?

Yes. 67% of small businesses stopped exporting to politically misaligned markets because compliance costs exceeded 15% of their revenue. For many, the paperwork, legal risk, and delays aren’t worth it.

Will this fragmentation last?

Most experts believe it will. Goldman Sachs gives a 65% chance of sustained fragmentation through 2040. Geopolitical tensions aren’t fading, and governments are investing billions to build self-reliant supply chains. Market forces may ease some pressures, but the structural shift is permanent.

How does this affect consumers?

Higher prices. Solar panels in Europe are 28% more expensive. Batteries, electronics, and medicines cost more due to supply chain rerouting and local manufacturing inefficiencies. The EU estimates consumer prices for strategic goods rose 4.3% on average since 2022.