Resilience Cost Calculator

Determine if resilience investments are justified for your critical components based on disruption risk and costs.

Based on the 80/20 rule: Invest in resilience if disruption cost > 5x redundancy cost

Example: If a disruption costs 5.8% of revenue and your redundancy cost is 1.2%, the math is 5.8% > 5 x 1.2% (6%). In this case, don't invest because the disruption cost is lower than the 5x threshold.

Results

For years, companies chased the lowest possible cost in their supply chains. Buy cheap, move fast, keep inventory lean. It worked-until it didn’t. The pandemic, the Suez Canal blockage, tariffs, floods in Vietnam, chip shortages, and political tensions turned supply chains from silent backbones into fragile strings. Now, every executive is asking: How much should we spend to avoid the next disaster?

The Hidden Cost of Being Too Lean

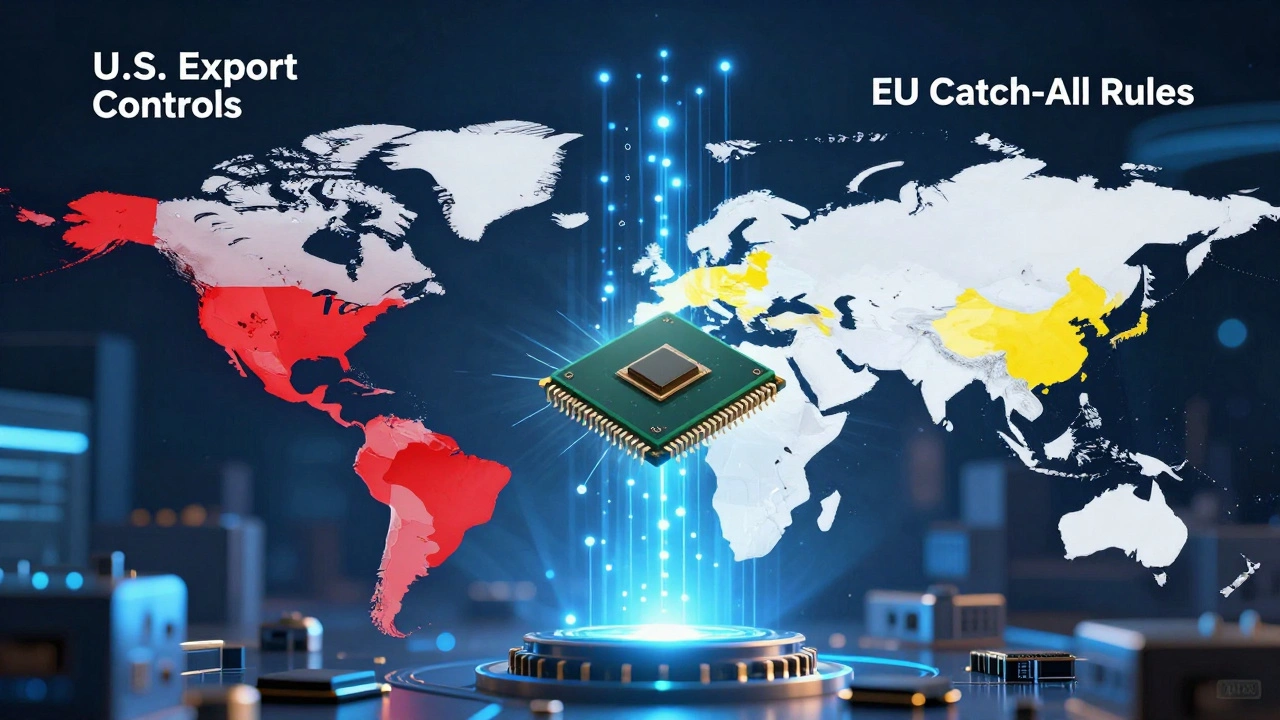

The old model treated supply chains like a spreadsheet: minimize cost per unit, maximize inventory turns, cut suppliers to the bone. But when a single factory in China shut down during the 2021 chip shortage, entire car plants in the U.S. and Europe sat idle. Companies that had no backup suppliers lost 5.8% of their annual revenue in downtime. Meanwhile, others with just a few buffer stocks kept running. Their inventory costs? Just 1.2% of revenue. The math wasn’t close. McKinsey found that over the last decade, the average company lost 45% of one year’s profits to supply chain disruptions. That’s not a one-time hit. It’s a recurring bleed. And it’s not just about natural disasters or pandemics. Geopolitical moves-like the U.S. slapping 25% tariffs on $50 billion worth of Chinese goods in 2018-created new, predictable risks. Yet many companies kept buying from the same low-cost suppliers, ignoring the fact that those suppliers were now exposed to political volatility.What Does Resilience Actually Cost?

Resilience isn’t about building a fortress around every part. That’s expensive-and often pointless. The real trick is knowing where to spend and where to save. BCG’s 2025 framework breaks this down into four big trends:- Economic statecraft: Tariffs and trade barriers are now permanent. Fluctuations of 25-30% are common between major blocs.

- Climate risk: By 2030, 30% of global supply chain nodes will face serious climate disruption.

- Robotics: Automation is shrinking the labor cost gap between Asia and North America by 25-40%.

- Talent shortage: 75% of manufacturers say they can’t find skilled workers to run new systems.

The 80/20 Rule of Resilience

You don’t need to protect everything. You need to protect what matters. Most companies have 15-20% of their SKUs that generate 70-80% of revenue. These are your “A” items. The rest? They’re “B” and “C.” A $2 billion industrial equipment maker in Ohio did a simple exercise: they mapped every component, ranked them by revenue impact, and focused only on the top 20%. They found 15-40% of their critical parts had only one supplier-some even had no backup at all. They dual-sourced only those. Added buffer stock for 12 semiconductor parts. Did stress tests on logistics routes. The result? A $18 million annual reduction in disruption costs. The added resilience cost? Just $4.2 million. That’s a 330% return. Compare that to a consumer goods company that tried to dual-source every critical part. Costs jumped 22%. Resilience? Barely improved. Why? Because they didn’t fix the real problem: their shipping routes all passed through the same congested port. No matter how many suppliers they had, everything got stuck in the same bottleneck.Localization Isn’t Always the Answer

“Bring it home,” they say. Reshore everything. Make it in America. Sounds patriotic. But the numbers tell a different story. Full reshoring to the U.S. can increase costs by 35-55%. For a basic plastic part? That’s not worth it. The supply chain risk is low. The cost spike is huge. But for a specialized medical device component with no alternatives? That’s different. The real winner? Nearshoring. Moving from China to Mexico, Eastern Europe, or Turkey. It’s not about nationalism-it’s about proximity. Lead times drop. Visibility improves. Risk exposure shrinks. And with automation closing the labor gap, the cost difference is shrinking fast. One automotive supplier moved three key components from China to Mexico. Costs went up 18%. But when the 2023 chip shortage hit, they kept 92% of production running. Competitors? 67%. Their extra inventory cost $8.5 million a year. Their competitors lost $5.8 million in revenue in just three months.

Where Companies Are Failing

Most resilience efforts fail-not because they’re too expensive, but because they’re poorly targeted. Here’s what goes wrong:- Overestimating alternatives: 42% of companies think they have backup suppliers-until they call them. Turns out, those suppliers use the same Chinese raw materials.

- Ignoring tier-two and tier-three suppliers: Your main supplier uses a part from a company in Thailand. That Thai company uses a chemical from a plant in India. One flood. One factory fire. Your whole line stops. Most companies don’t even map beyond Tier 1.

- Underestimating transition costs: Moving production takes longer and costs 25-35% more than planned. Budgets don’t account for tooling, training, or regulatory delays.

- Creating new risks: One food company moved production to Vietnam to avoid China. Then Vietnam flooded. Both sites went down. They didn’t check the climate risk profile of their “safe” alternative.

Building Adaptive Capacity, Not Just Buffer Stock

Dr. Hau Lee from Stanford says it best: “The most resilient supply chains aren’t the most redundant-they’re the most adaptable.” That means:- Real-time visibility into supplier health, inventory levels, and shipping delays.

- Pre-negotiated contracts with backup suppliers so you can switch in under 30 days.

- Flexible manufacturing that can reroute production across multiple plants.

- Decision rules: “If a component’s disruption would cost more than five times its annual redundancy cost, we dual-source it.”

The New Metrics That Matter

Forget inventory turnover. Stop obsessing over cost-per-unit. Here’s what you should track instead:- Time-to-switch suppliers: Can you replace a key part in 30 days or less?

- Geographic concentration index: Is more than 60% of your critical suppliers in one country or region?

- Single-point-of-failure exposure: What percentage of critical components have only one supplier?

- Buffer stock cost as % of revenue: Are you spending 8-15% more on inventory? Is it worth it?

What’s Next? AI, Digital Twins, and Real-Time Decisions

The next wave isn’t about adding more suppliers. It’s about predicting when and where things will break. AI-powered risk models now reduce false alarms by 65%. Blockchain tracks parts from raw material to final assembly. Digital twins simulate disruptions before they happen. By 2027, 70% of leading companies will use these tools to calculate the exact ROI of every resilience move. But here’s the catch: the best strategy today might be obsolete in 18 months. Tariffs change. Climate patterns shift. New suppliers emerge. That’s why static plans fail. The winners are those who build systems that can evolve-fast.Where to Start Today

You don’t need a $10 million tech upgrade. Start small:- Identify your top 20% of SKUs by revenue.

- Map every supplier-down to Tier 3.

- Find every single-point-of-failure.

- Calculate the cost of a 30-day disruption for each critical part.

- Set a rule: “If disruption cost > 5x redundancy cost, act.”

- Pilot with 3-5 parts. Measure results. Scale.

Final Thought: Resilience Isn’t a Cost Center. It’s a Profit Lever.

The companies that win the next decade won’t be the ones with the cheapest supply chains. They’ll be the ones that turned resilience into a competitive advantage. They’ll know exactly where to spend-and where to save. They’ll recover faster. They’ll keep customers. They’ll outlast the chaos. The price of redundancy isn’t high. The price of ignoring it? That’s the real cost.Is nearshoring always cheaper than reshoring?

No, but it’s often the better balance. Nearshoring to Mexico or Eastern Europe typically increases production costs by 15-25%, but cuts lead times from 60 days to 10 and reduces shipping costs by 30-40%. Reshoring to the U.S. can raise costs by 35-55% with little extra resilience for many products. Nearshoring gives you speed and flexibility without the massive price tag.

How do I know which parts need redundancy?

Focus on the 15-20% of SKUs that generate 70-80% of your revenue. Map their entire supply chain-down to Tier 3 suppliers. Identify any part with only one source. Then calculate: if that part failed, how much revenue would you lose in 30 days? If that loss is more than five times the cost of adding a backup supplier or buffer stock, invest in redundancy.

Can automation make offshoring obsolete?

It’s already making it less relevant. Robotics and AI are reducing labor cost differences between Asia and North America by 25-40%. That means the main advantage of offshoring-cheap labor-is fading. Proximity, speed, and risk control now matter more. A factory in Texas with robots can compete with one in Vietnam-even if wages are higher.

What’s the biggest mistake companies make when building resilience?

Trying to protect everything. Resilience isn’t about adding backup suppliers for every part. It’s about protecting what matters. Companies that dual-source all critical components end up spending 20-30% more with little improvement. The smart ones focus on the top 20% of SKUs, map their full supply chain, and fix only the real vulnerabilities.

How long does it take to build a resilient supply chain?

You can see results in 90 days with a focused pilot-like fixing three high-risk parts. Full organizational adoption takes 9-12 months. It’s not a project. It’s a cultural shift. You need cross-functional teams, executive buy-in, and real-time data tools. But the first win-saving $5 million from one avoided shutdown-is worth the effort.

Are government subsidies worth relying on for reshoring?

Not as a long-term strategy. The U.S. CHIPS Act and EU’s Critical Raw Materials Act offer billions in subsidies, but they’re temporary. Companies that build resilience only because of subsidies often abandon it when funding ends. True resilience comes from market-driven decisions-not government handouts. Use subsidies to jumpstart, not to build your entire strategy.

Does resilience increase inflation?

Yes, but not because of the companies. The Richmond Fed estimates that policies pushing reshoring, tariffs, and domestic incentives could add 0.3-0.7 percentage points to annual inflation in advanced economies. That’s because higher production costs get passed to consumers. But that’s the cost of reducing trade fragmentation. The alternative-constant disruptions and lost production-can be worse for the economy long-term.