Global Finance: How Trade Wars, Sovereign Funds, and Currency Moves Shape Your Money

When we talk about global finance, the system of cross-border money flows, investment strategies, and economic policies that connect nations through capital. Also known as international finance, it's not just about Wall Street or the IMF—it's about how a seafood ban in China can crash a Japanese fishing town, or how a U.S. interest rate change makes investors borrow money in Japan to buy tech stocks. This isn't abstract theory. It's what’s in your grocery bill, your paycheck, and your retirement account.

Behind every big move in global finance, the system of cross-border money flows, investment strategies, and economic policies that connect nations through capital. Also known as international finance, it's not just about Wall Street or the IMF—it's about how a seafood ban in China can crash a Japanese fishing town, or how a U.S. interest rate change makes investors borrow money in Japan to buy tech stocks. is a hidden game of power. Take the dollar carry trade, a strategy where investors borrow low-interest currencies to invest in higher-yielding U.S. assets, then hedge against currency swings. Also known as currency arbitrage, it's how hedge funds make billions while ordinary people feel the ripple in their mortgage rates. Or look at sovereign wealth funds, state-owned investment pools that manage billions from oil, minerals, or trade surpluses to buy global assets. Also known as national investment funds, they’re shifting away from tech stocks—not because tech is weak, but because they’re tired of putting all their eggs in one basket. These aren’t random decisions. They’re reactions to trade wars, sanctions, and broken rules.

And when rules break down? That’s where international law, the set of treaties and courts meant to govern how nations interact, especially in disputes. Also known as public international law, it's the legal framework that sounds powerful but can’t force China to lift a seafood ban or make the U.S. pay up after breaking a trade deal. The ICJ, the United Nations’ top court for resolving disputes between countries. Also known as World Court, it’s like a referee with no authority to call a timeout. It can rule that a country broke the law—but if that country is powerful enough, it just walks away. That’s why tariffs, sanctions, and trade bans are the real tools of power today.

What you’ll find here isn’t just news. It’s the blueprint. You’ll see how tariff scenarios for 2026 will hit your wallet, why Japan lost $800 million overnight because of a single trade move, and how countries are trying to build accountability into pandemic treaties so they can’t just ignore health emergencies. These aren’t distant events. They’re the same forces shaping inflation, job markets, and investment risks right now. This collection cuts through the noise—showing you who wins, who loses, and why it matters to you.

FX-linked supply contracts help businesses protect profit margins by tying international purchase prices to real-time exchange rates. This prevents currency swings from disrupting budgets, inventory, and supplier relationships.

Ukraine’s post-war recovery is at risk as high-level corruption scandals, like the $110 million Operation Midas case, divert critical aid funds, erode international trust, and strengthen Russian influence through stolen money and compromised institutions.

Digital trade rules are fragmenting global commerce. Data localization laws, privacy regulations, and conflicting cross-border data rules are creating legal traps for businesses. Here’s how companies can survive-and thrive-in 2026.

Public-private climate partnerships are the most effective way to fund resilient infrastructure at scale. Learn how structured contracts, risk-sharing, and policy support make these projects bankable for investors and vital for communities.

Cross-border capital flows are fragmenting as geopolitical tensions reshape FDI and portfolio investment patterns. FDI is becoming more regional and stable, while portfolio flows are fleeing uncertainty-creating new winners, losers, and risks in global finance.

Cross-border capital flows are fragmenting as geopolitics reshape investment patterns. FDI is holding steady while portfolio flows retreat, pushing capital into regional blocs and raising costs for emerging markets. Here's what's really happening.

AI equity concentration is reshaping global markets, with a few tech giants driving most index returns. This creates hidden portfolio risk-diversification is an illusion when assets move in lockstep. Learn how to manage exposure, avoid overvaluation traps, and build resilient portfolios using core-satellite strategies and global diversification.

The WTO warns that global trade growth in 2026 will plummet to just 0.5% due to rising tariffs and protectionist policies, threatening global economic stability and reshaping supply chains worldwide.

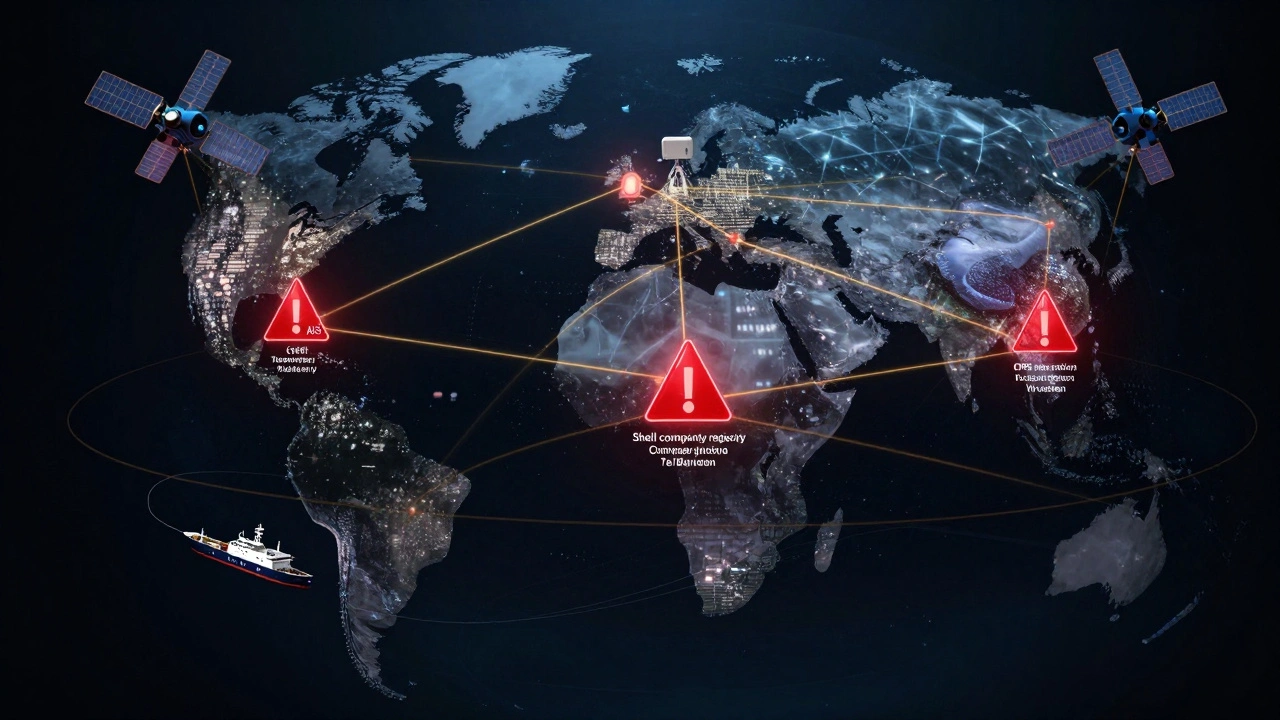

Sanctions only work if enforced. Allies are now sharing real-time data on shell companies, shipping routes, and payment systems to stop evasion-using AI, satellite tracking, and joint enforcement to close the gaps.

Remittances from migrants are a $700+ billion global force-more than foreign aid. Yet most go to basic needs. This article shows how turning them into productive investment can transform development, with real examples from India, Africa, and digital innovations.

In times of economic uncertainty, smart companies don't hoard cash or chase growth at all costs. They use disciplined capital allocation - strategic cash reserves, controlled buybacks, and ruthless capex discipline - to survive and outperform. Here's how.

In 2025, venture funding hit $425 billion as investors shifted from pure AI plays toward frontier technologies like robotics and climate solutions-driven by regulation, maturing tech, and real-world demand.